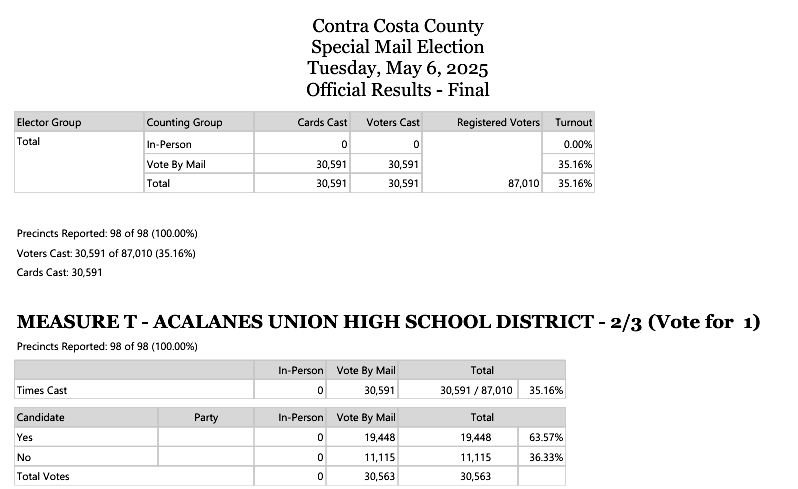

MEASURE T DEFEATED!

Why Our Community Says SAID NO to AUHSD Measure T

Residents voiced their concerns about the proposed parcel tax, highlighting its potential impact on our community. We weren't fooled by the fear-mongering tactics of students going without.

AUHSD increased its General Administrative Expense by 31% since 2017.

Funding wasn't the problem, poor leadership IS.

Here’s why this tax was not the right choice, nor was it the right time for the Acalanes Union High School District.

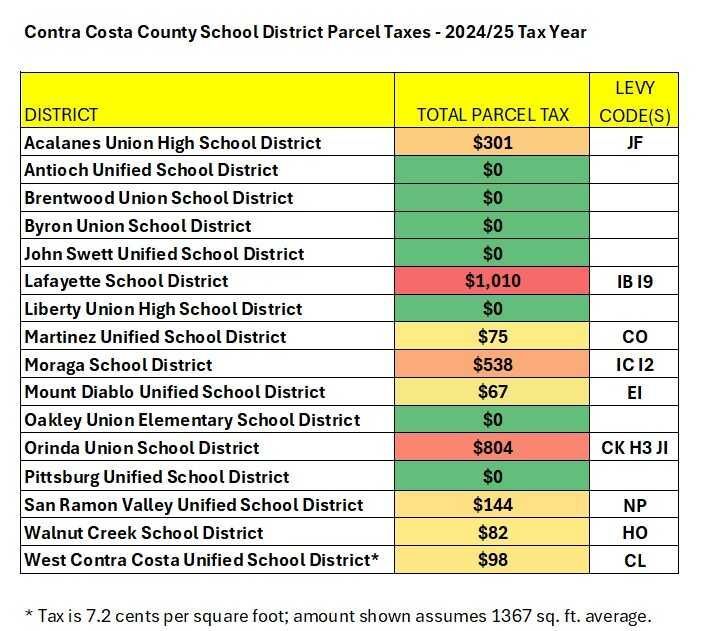

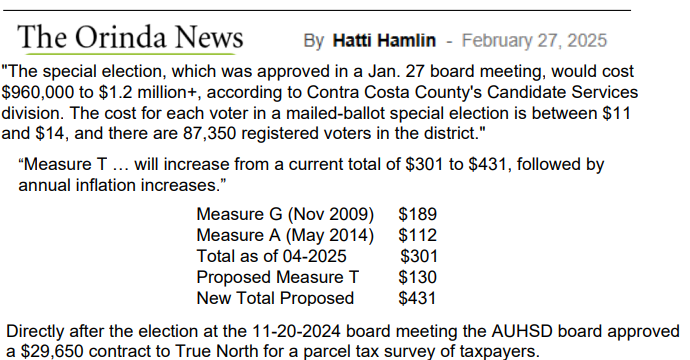

Unnecessarily Overtaxed

Negligent Liability

"Will Measure T parcel tax proceeds pay for AP classes or be used to settle sexual assault claims from 2009? AB 218 (2019) allowed former students to sue school districts for negligence if they were victimized by school employees many years ago.

In 2022, three graduates of Miramonte High School in Orinda..." more...

AUHSD has a long history of failing to protect students from sexual abuse and harassment. It has allowed staff members to keep their jobs even after being presented with evidence of sexual grooming, and it is currently defending a lawsuit by three Miramonte students who were groomed and sexually abused by a teacher whose conduct was ignored by the District. Its Associate Superintendent was personally sued for failing to protect students from a sexual abuser at a Union City high school before she moved to AUHSD. The District hired an independent investigator to look into sex harassment at Las Lomas High School but has refused to release the results of that investigation to the public. Not only is the District failing to adequately protect our students, but it is spending tax dollars on lawyers’ fees and settlements of sex abuse claims instead of educating our students.

Concerned Citizen

"Even today, as my posts below explain, the District continues its policies in defiance of law. The LCAP for years expressly tracks how well the District is performing to comply with hiring policies based on demographics, which is contrary to law; contrary to long-standing express Supreme Court precedent finding such hiring practices to be illegal." more...

Enrollment⬇️260 Expenses⬆️$1.4M

| Year | ADA* | ⬆️/⬇️ Prior Year (Since 2017) | Admin Expense** | ⬆️/⬇️ Prior Year (Since 2017) |

|---|---|---|---|---|

| 2023/24 | 5184 | ⬆️ 61 (⬇️265) | $6,132,167 | ⬇️ $92,625 (⬆️$1,452,770) |

| 2022/23 | 5123 | ⬇️ 84 (326) | $6,224,792 | ⬆️ $670,856 ($1,545,395) |

| 2021/22 | 5207 | ⬇️ 175 (242) | $5,553,936 | ⬆️ $129,268 ($874,539) |

| 2020/21 | 5382 | ⬇️ 31 (67) | $5,424,668 | ⬆️ $711,547 ($745,271) |

| 2019/20 | 5413 | ⬇️ 14 (36) | $4,713,121 | ⬆️$155,076 ($33,724) |

| 2018/19 | 5427 | ⬆️ 22 | $4,558,045 | ⬇️ $121,352 |

| 2017/18 | 5405 | - | $4,679,397 | - |

*Average Daily Attendance

** General Fund Expenditures Function Code 7000-7999

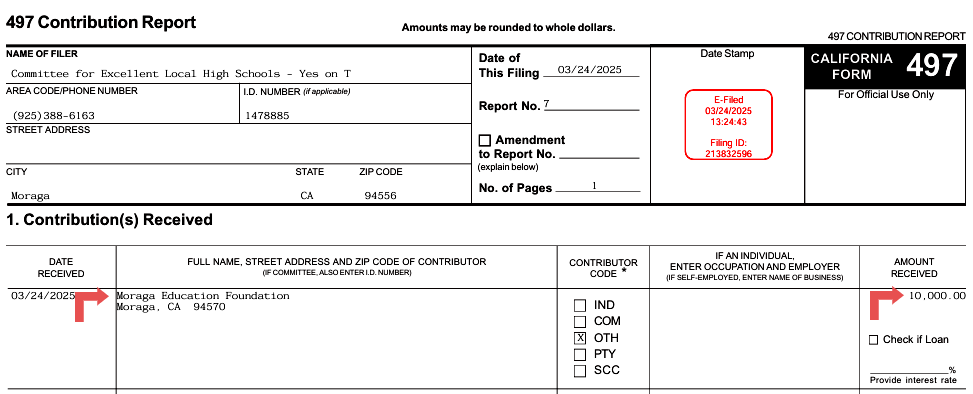

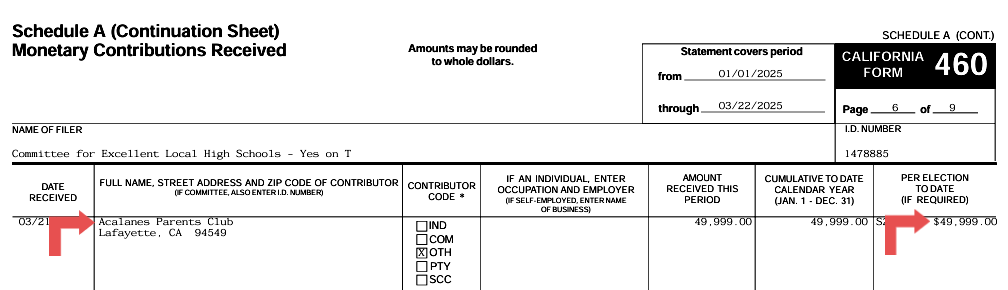

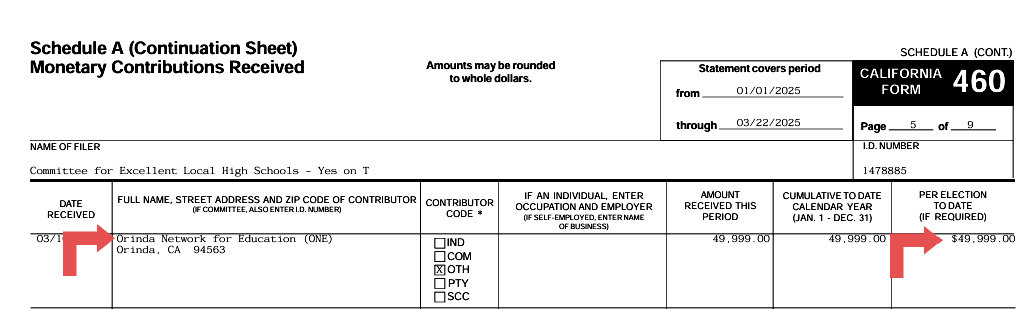

$100K+ Tax Exempt Donations Moved to Political Contributions